Post by Iqbal Zulkarnain on Jul 19, 2012 16:14:09 GMT 7

[glow=red,2,300]Money Goes Mobile[/glow]

“Life is like riding a bicycle, to keep your balance you must keep moving”

-Albert Einstein-

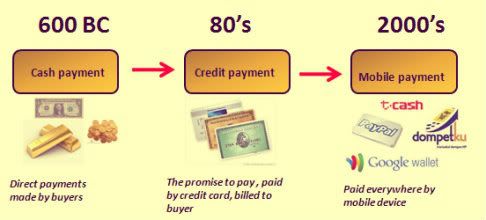

Do you have a scale ? please put it on your table, take out your wallet and weight it. How many grams ? I’m sure your wallet is lighter than your grandpa wallet about ten years ago. Now note it on your personal note and you may do it again for the next ten years . Still the same ? or do you still have a wallet ? Why it can be happened? Now, our cash or bank notes seems not real. The cash stored in a card. Peoples just put a card in their wallet. Only few cash stored in the wallet. In emerging market like Indonesia, at least one people have two credit card or debit card. Why this trend can be happened ? The answer is mobile networks. Mobile networks made not only to used for voice, surfing internet or updated your FB status. It made to ease people life. All things can do with mobile networks. Today, It is getting easier and easier for peoples to do money transaction anywhere in the world as new technologies come to market using cell phones and payment networks.

. Still the same ? or do you still have a wallet ? Why it can be happened? Now, our cash or bank notes seems not real. The cash stored in a card. Peoples just put a card in their wallet. Only few cash stored in the wallet. In emerging market like Indonesia, at least one people have two credit card or debit card. Why this trend can be happened ? The answer is mobile networks. Mobile networks made not only to used for voice, surfing internet or updated your FB status. It made to ease people life. All things can do with mobile networks. Today, It is getting easier and easier for peoples to do money transaction anywhere in the world as new technologies come to market using cell phones and payment networks.

There’s a major transformation happening between people and their relationship to their money, a transformation enabled by the arrival of mobile payment. The magnitude of the change and disruption caused by mobile payments will greatly impact consumers, bank, retailers, wireless carriers among others and will be felt across the globe. Mobile payment landscape is rapidly evolving with many different players, technologies and alliance. They are fighting to assert their relevance and control between consumer and money.

Obviously, these trends profoundly affect the way merchants and financial institutions will do business in the future. Not only are the channels for marketing and customer interaction evolving. The very foundation of payments is in the process of undergoing dramatic changes to accommodate consumer expectations for convenience, security and mobility. To meet these developing payment needs, throngs of new players are crowding into the marketplace, including technology providers, mobile network operators, Internet start-ups, and other untraditional new entrants that threaten to disrupt existing consumer relationships.

What is Mobile Money ?

Mobile money presents a next-generation conduit for financial interfaces, connecting alternative and established banking structures with consumers through mobile telecommunications. The potential of these services extends beyond established sectors, serving as a transformative agent .Mobile money presents an opportunity to empower large segments of the population by providing access to finance through open access ecosystems that are enabled by mobile telecommunication networks. Positive impacts of an expanded mobile money footprint and supporting ecosystem include:

- Increasing the number of people participating in the formal financial sector

- Increasing access to credit through channel efficiency and better credit rating data

- Increasing access to secure savings products

- Reducing transaction costs for a range of payments in the overall economy

- Improving security as the need for physical currency becomes less necessary

- Improving transparency as payments and funds transfer go directly from a payer to the ultimate recipient

- Accelerate development of more sophisticated value-added financial services as the market expands

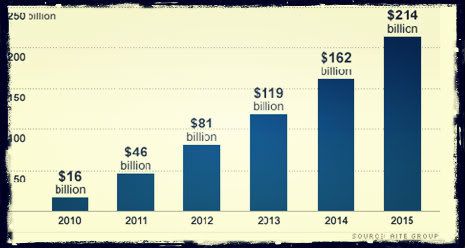

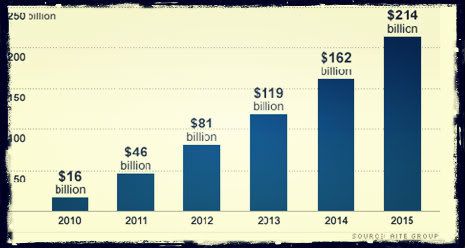

Mobile money will become a trend for financial transaction. Mobile money will give significant transaction growth in the next banking system era.

mobile money transaction

There will be about 214 Billion USD transaction with mobile money. Total transaction of mobile money will become the future business for mobile operator.

Emerging Market Opportunities

In emerging markets, formal banking only reaches a small percent of the population, compared with high penetration rate for mobile phones. Low access to financial services, encourages them to use easier way to carry out financial activities. From the point at view, we can see that the issue will be the opportunity of mobile money in the future. There were many reason why mobile money is the future challenge for operator business :

1. Mobile Operators Customer Base

In emerging market, mobile handset penetration was growth exponentially year by year. In example, Indonesia's mobile market passed 230 million subscribers in mid-2011 with penetration running at just over 100%. It means that mobile operators had base customer larger than banking customer. BRI (Bank Rakyat Indonesia) have the largest customer with 33 million customer followed by BNI (Bank Negara Indonesia) and Bank mandiri about 11 million customer. If we see the mobile operator customers, Telkomsel has about 100 million customers followed by Indosat with 53 million customer and XL with about 47 million customer. From its base customer, mobile operators have new business opportunity for mobile money with their customers.

2. Financial Institution/Banking Penetration

In emerging market there were many unbanked. Investing on a bank in emerging markets carries an element of risk. Banks need to understand the local market, such as its regulations and service expectations, and deploy flexible solutions that meet the requirements of their customers at an attractive price point.

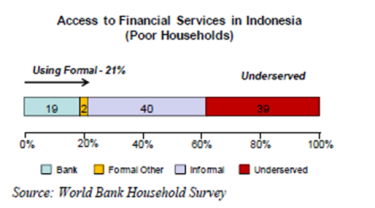

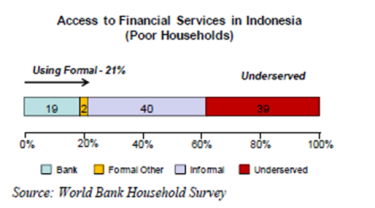

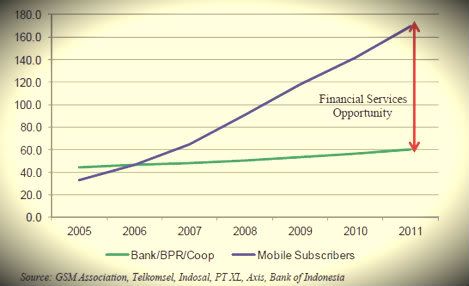

Figure above highlight the current challenges facing the Indonesian banking sector in reaching low income market segments. In fact, Indonesia has 9.8 million saver/bank customers, means only 19% penetration from about 240 million peoples, largerly in main city. Undeniable coverage penetration of bank/financial institution in Indonesia is very difficult due to lack of infrastructure and security,like on many emerging countries.

In contrast, as in many markets around the world, Indonesian telecommunications sector has been extremely effective in moving down market. Low cost handsets, prepaid accounts and a variety of small increment airtime purchase options have made cellular telephones affordable to a majority of Indonesians. This broad market appeal has enabled mobil operators to expand coverage and diversify products. Strong competition among the eight current service providers has provided low-income segments with a range of service and product options. It is estimated that there are nearly 230 million subscribers in Indonesia, with numbers still growing.

3. Economic growth in emerging market

Today, emerging markets serve as the world's economic growth engine, and the far-reaching effects of their spectacular rise continue to play out. Emerging market is growing above 5% while global economic growth only run at 3.3 %. Emerging market will surge demand on capital. Financial institution is the main player in economic growth. Several factors contributing to the growth of the emerging markets’ financial sector, demography and technology are perhaps the most important. There is ample evidence from countries such as China, India, Indonesia and the Philippines of their youthful populations’ willingness to adopt new channels and practices that have come by as a result of automation of core banking activity. This openness to new technology is reflected in the high mobile penetration, and even more by the acceleration of mobile communication into mobile banking and commerce. What’s more, the ready adoption of technology is not restricted to the urban elite. With mobile operators playing their trade deep within rural areas.Mobile operator new business chance will happened in this area.

Mobile Money Capabilities

Combining financial sector expertise with the broad market capabilities of the mobile telecommunications channel presents a unique opportunity for governments and commercial entities to expand access to financial services and develop new business opportunities.

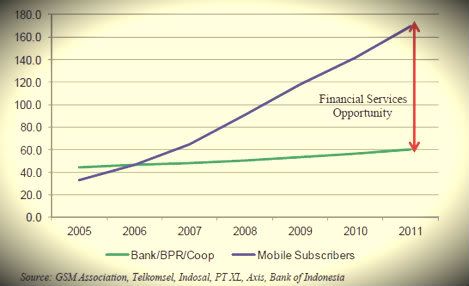

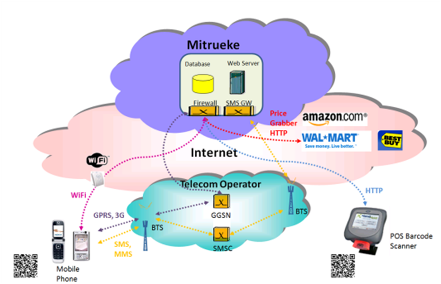

Figure above highlight the gap between telecommunications access and financial services access. It is this gap that mobile money initiatives seek to address. Mobile money services in Indonesia are delivered by banks, micro finance institutions, mobile operators, and third-party providers. These groups represent a range of services, operating models, license regimes, and market segments. Some mobile money services are SMS (Short Message Service) based and available on any handset in the market. Others, use a sophisticated application and require smartphones and higher bandwidths.

Indonesia’s mobile money market is characterized by both bank and mobile operators product offerings. Several mobile operators, including Telkomsel, Indosat, XL, and Axis, have invested in mobile money platforms, with Telkomsel and Indosat providing some form of branded services (T-Cash and Dompetku). Such major banks as Bank Mandiri and BCA provide customers with a mobile money application that enables bank functions including transfers and bill payment. To date, neither mobile operators nor banks have aggressively pursued mobile money as a strategic business proposition or business line with high-profit potential. Mobile operators view their mobile money business lines as added services that further link customers to their telephone numbers., Mobile operators hope to reduce churn by adding this linkage. Banks view the mobile channel as a cost reduction strategy that reduces their operational costs, as the need for tellers, branches, and ATMs and lowers the cost per transaction. Neither group has invested heavily in a mobile money support ecosystem (e.g., mobile money agents or retail acceptance points). While regulatory factors contribute to this lack of investment, major mobile money providers also seem reluctant to commit to mobile money without a clearer business case. Consequently, in most cases, mobile money providers do not use their capability to target new customer segments and take a wait-and-see attitude toward ecosystem development.

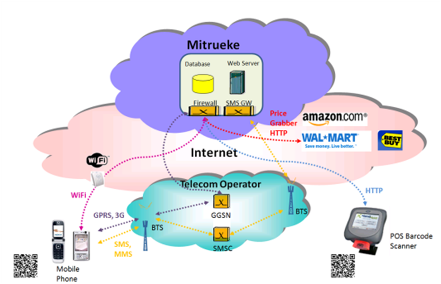

In addition to mobile operators and banks will need third party providers to offer mobile money capabilities. Smart application based on mobile transaction will help both to expand their market. Smart application will ease customer to access mobile transaction.

The Future of Mobile Money

Currently there were three types of mobile transaction model offered from mobile operators :

- SMS Based

- USSD Based

- Web Browser based

As line as growth of variation from banking transaction, using three types of current mobile transaction may unfavorable in the future. Once SMS/USSD network have trouble, content delivery of SMS/USSD will takes time. Other unfavorable is command. SMS have standard command that the customers must known.USSD menu will become complicated along with vary of transaction. Web browser may unfavorable in the future due to customers habbit with one click application on their smartphones.

Contactless mobile payment and smart application will become the next development of mobile transaction. NFC (Near Field Communication) will becoming trend to the physical way of mobile transaction. NFC is a set of standards for smartphones and similar devices to establish radio communication with each other by touching them together or bringing them into close proximity, usually no more than a few centimeters. Its like tapped for a credit card/flashcard. The technology is built up on the existing RFID standards. However, there are minor differences, and NFC devices cannot interact with some of the legacy systems. NFC devices are operating at at 13.56 MHz and can transfer data at up to 424 Kbps.

The alternative way from NFC to ease customers to access mobile transaction with development of smart application from the 3rd party developer. With one single click, customers can access interesting menu for payment transaction. By partnering, rather than competing, with OTT players and financial institution like local banks, Mastercard, Visa, paypal, even with kaskus (forum jual beli), etc, mobile operators can bring their own capabilities to mobile money content and applications development and stave off commoditization. Example for Google wallet that has developed Mobile payment partnership with Mastercard for NFC and smart application. Operators should begin to focus on identifying new revenue opportunities from mobile money transaction, not only from current way like SMS,USSD and web browsing. Mobile operators can make strategy for revenue share or content acquisition from 3rd party developer to create mobile money application. In Advanced way mobile operator can bring open API for developers. This way can speed up content creation for market. At least operator will choose suitable mobile money content and application for customers. Revenue share or acquisition with individual/small content developer or even big content developer by give them software development kit. By this way operator can get revenue through share of service revenue.

The Barriers

While the Indonesian mobile money sector has many strong attributes, including multiple competitors, technology, strong mobile penetration, coverage, and a significant underserved market segment, current mobile money adoption and usage levels are below expectations. Two primary reasons for this are regulatory policies and mobile money provider commitment. On the regulatory front, Bank Indonesia has been actively reviewing its mobile money policies. Current rules require mobile money agents to be formally registered businesses, and most apply individually for the appropriate agent licenses. These restrictions greatly hamper a mobile money provider’s ability to sign up agents, particularly small retail businesses. Consequently, the availability of mobile money agents in Indonesia is extremely low, greatly limiting the utility of the service. In addition to regulatory impediments, the mobile money sector can also be characterized by a lack of urgency on the part of service providers. Mobile operators did not view expanding mobile money services as a top priority, and available resources have been limited. To date, the business case for mobile operators to invest heavily in agent networks, customer acquisition, merchant promotions and incentives has not been made. For most mobile operators, mobile money is a competitive necessity that supports broader churn reduction efforts rather than a core source of profits. Banks and other financial institutions also have not actively promoted their mobile money capabilities and have not effectively used the mobile channel’s cost advantage as a mechanism to move down-market and acquire previously unbanked customers. Currently they are concentrating for internet banking, EDC machine and ATM as main cost transaction reduction strategy, not yet from mobile banking. Only few mobile banking transaction has been carried from banks. But, most banks have viewed mobile money as a cost reduction tool to lower transaction costs for existing customers. Several banks are reevaluating this position, with a few engaging in mobile money pilots that will test the efficacy of using mobile money to acquire and service low-end customers.

As conclusion, Mobile money offers numerous benefits in emerging markets. They ensure the safety and security of money, make payments more convenient and promote M-Commerce opportunities for local entrepreneurs. They also present opportunities for foreign companies looking to move into these markets, as well as learning’s for those who want to implement similar mobile finance models in developed markets

Author : Iqbal Zulkarnain

“Life is like riding a bicycle, to keep your balance you must keep moving”

-Albert Einstein-

Do you have a scale ? please put it on your table, take out your wallet and weight it. How many grams ? I’m sure your wallet is lighter than your grandpa wallet about ten years ago. Now note it on your personal note and you may do it again for the next ten years

. Still the same ? or do you still have a wallet ? Why it can be happened? Now, our cash or bank notes seems not real. The cash stored in a card. Peoples just put a card in their wallet. Only few cash stored in the wallet. In emerging market like Indonesia, at least one people have two credit card or debit card. Why this trend can be happened ? The answer is mobile networks. Mobile networks made not only to used for voice, surfing internet or updated your FB status. It made to ease people life. All things can do with mobile networks. Today, It is getting easier and easier for peoples to do money transaction anywhere in the world as new technologies come to market using cell phones and payment networks.

. Still the same ? or do you still have a wallet ? Why it can be happened? Now, our cash or bank notes seems not real. The cash stored in a card. Peoples just put a card in their wallet. Only few cash stored in the wallet. In emerging market like Indonesia, at least one people have two credit card or debit card. Why this trend can be happened ? The answer is mobile networks. Mobile networks made not only to used for voice, surfing internet or updated your FB status. It made to ease people life. All things can do with mobile networks. Today, It is getting easier and easier for peoples to do money transaction anywhere in the world as new technologies come to market using cell phones and payment networks. There’s a major transformation happening between people and their relationship to their money, a transformation enabled by the arrival of mobile payment. The magnitude of the change and disruption caused by mobile payments will greatly impact consumers, bank, retailers, wireless carriers among others and will be felt across the globe. Mobile payment landscape is rapidly evolving with many different players, technologies and alliance. They are fighting to assert their relevance and control between consumer and money.

Obviously, these trends profoundly affect the way merchants and financial institutions will do business in the future. Not only are the channels for marketing and customer interaction evolving. The very foundation of payments is in the process of undergoing dramatic changes to accommodate consumer expectations for convenience, security and mobility. To meet these developing payment needs, throngs of new players are crowding into the marketplace, including technology providers, mobile network operators, Internet start-ups, and other untraditional new entrants that threaten to disrupt existing consumer relationships.

What is Mobile Money ?

Mobile money presents a next-generation conduit for financial interfaces, connecting alternative and established banking structures with consumers through mobile telecommunications. The potential of these services extends beyond established sectors, serving as a transformative agent .Mobile money presents an opportunity to empower large segments of the population by providing access to finance through open access ecosystems that are enabled by mobile telecommunication networks. Positive impacts of an expanded mobile money footprint and supporting ecosystem include:

- Increasing the number of people participating in the formal financial sector

- Increasing access to credit through channel efficiency and better credit rating data

- Increasing access to secure savings products

- Reducing transaction costs for a range of payments in the overall economy

- Improving security as the need for physical currency becomes less necessary

- Improving transparency as payments and funds transfer go directly from a payer to the ultimate recipient

- Accelerate development of more sophisticated value-added financial services as the market expands

Mobile money will become a trend for financial transaction. Mobile money will give significant transaction growth in the next banking system era.

mobile money transaction

There will be about 214 Billion USD transaction with mobile money. Total transaction of mobile money will become the future business for mobile operator.

Emerging Market Opportunities

In emerging markets, formal banking only reaches a small percent of the population, compared with high penetration rate for mobile phones. Low access to financial services, encourages them to use easier way to carry out financial activities. From the point at view, we can see that the issue will be the opportunity of mobile money in the future. There were many reason why mobile money is the future challenge for operator business :

1. Mobile Operators Customer Base

In emerging market, mobile handset penetration was growth exponentially year by year. In example, Indonesia's mobile market passed 230 million subscribers in mid-2011 with penetration running at just over 100%. It means that mobile operators had base customer larger than banking customer. BRI (Bank Rakyat Indonesia) have the largest customer with 33 million customer followed by BNI (Bank Negara Indonesia) and Bank mandiri about 11 million customer. If we see the mobile operator customers, Telkomsel has about 100 million customers followed by Indosat with 53 million customer and XL with about 47 million customer. From its base customer, mobile operators have new business opportunity for mobile money with their customers.

2. Financial Institution/Banking Penetration

In emerging market there were many unbanked. Investing on a bank in emerging markets carries an element of risk. Banks need to understand the local market, such as its regulations and service expectations, and deploy flexible solutions that meet the requirements of their customers at an attractive price point.

Figure above highlight the current challenges facing the Indonesian banking sector in reaching low income market segments. In fact, Indonesia has 9.8 million saver/bank customers, means only 19% penetration from about 240 million peoples, largerly in main city. Undeniable coverage penetration of bank/financial institution in Indonesia is very difficult due to lack of infrastructure and security,like on many emerging countries.

In contrast, as in many markets around the world, Indonesian telecommunications sector has been extremely effective in moving down market. Low cost handsets, prepaid accounts and a variety of small increment airtime purchase options have made cellular telephones affordable to a majority of Indonesians. This broad market appeal has enabled mobil operators to expand coverage and diversify products. Strong competition among the eight current service providers has provided low-income segments with a range of service and product options. It is estimated that there are nearly 230 million subscribers in Indonesia, with numbers still growing.

3. Economic growth in emerging market

Today, emerging markets serve as the world's economic growth engine, and the far-reaching effects of their spectacular rise continue to play out. Emerging market is growing above 5% while global economic growth only run at 3.3 %. Emerging market will surge demand on capital. Financial institution is the main player in economic growth. Several factors contributing to the growth of the emerging markets’ financial sector, demography and technology are perhaps the most important. There is ample evidence from countries such as China, India, Indonesia and the Philippines of their youthful populations’ willingness to adopt new channels and practices that have come by as a result of automation of core banking activity. This openness to new technology is reflected in the high mobile penetration, and even more by the acceleration of mobile communication into mobile banking and commerce. What’s more, the ready adoption of technology is not restricted to the urban elite. With mobile operators playing their trade deep within rural areas.Mobile operator new business chance will happened in this area.

Mobile Money Capabilities

Combining financial sector expertise with the broad market capabilities of the mobile telecommunications channel presents a unique opportunity for governments and commercial entities to expand access to financial services and develop new business opportunities.

Figure above highlight the gap between telecommunications access and financial services access. It is this gap that mobile money initiatives seek to address. Mobile money services in Indonesia are delivered by banks, micro finance institutions, mobile operators, and third-party providers. These groups represent a range of services, operating models, license regimes, and market segments. Some mobile money services are SMS (Short Message Service) based and available on any handset in the market. Others, use a sophisticated application and require smartphones and higher bandwidths.

Indonesia’s mobile money market is characterized by both bank and mobile operators product offerings. Several mobile operators, including Telkomsel, Indosat, XL, and Axis, have invested in mobile money platforms, with Telkomsel and Indosat providing some form of branded services (T-Cash and Dompetku). Such major banks as Bank Mandiri and BCA provide customers with a mobile money application that enables bank functions including transfers and bill payment. To date, neither mobile operators nor banks have aggressively pursued mobile money as a strategic business proposition or business line with high-profit potential. Mobile operators view their mobile money business lines as added services that further link customers to their telephone numbers., Mobile operators hope to reduce churn by adding this linkage. Banks view the mobile channel as a cost reduction strategy that reduces their operational costs, as the need for tellers, branches, and ATMs and lowers the cost per transaction. Neither group has invested heavily in a mobile money support ecosystem (e.g., mobile money agents or retail acceptance points). While regulatory factors contribute to this lack of investment, major mobile money providers also seem reluctant to commit to mobile money without a clearer business case. Consequently, in most cases, mobile money providers do not use their capability to target new customer segments and take a wait-and-see attitude toward ecosystem development.

In addition to mobile operators and banks will need third party providers to offer mobile money capabilities. Smart application based on mobile transaction will help both to expand their market. Smart application will ease customer to access mobile transaction.

The Future of Mobile Money

Currently there were three types of mobile transaction model offered from mobile operators :

- SMS Based

- USSD Based

- Web Browser based

As line as growth of variation from banking transaction, using three types of current mobile transaction may unfavorable in the future. Once SMS/USSD network have trouble, content delivery of SMS/USSD will takes time. Other unfavorable is command. SMS have standard command that the customers must known.USSD menu will become complicated along with vary of transaction. Web browser may unfavorable in the future due to customers habbit with one click application on their smartphones.

Contactless mobile payment and smart application will become the next development of mobile transaction. NFC (Near Field Communication) will becoming trend to the physical way of mobile transaction. NFC is a set of standards for smartphones and similar devices to establish radio communication with each other by touching them together or bringing them into close proximity, usually no more than a few centimeters. Its like tapped for a credit card/flashcard. The technology is built up on the existing RFID standards. However, there are minor differences, and NFC devices cannot interact with some of the legacy systems. NFC devices are operating at at 13.56 MHz and can transfer data at up to 424 Kbps.

The alternative way from NFC to ease customers to access mobile transaction with development of smart application from the 3rd party developer. With one single click, customers can access interesting menu for payment transaction. By partnering, rather than competing, with OTT players and financial institution like local banks, Mastercard, Visa, paypal, even with kaskus (forum jual beli), etc, mobile operators can bring their own capabilities to mobile money content and applications development and stave off commoditization. Example for Google wallet that has developed Mobile payment partnership with Mastercard for NFC and smart application. Operators should begin to focus on identifying new revenue opportunities from mobile money transaction, not only from current way like SMS,USSD and web browsing. Mobile operators can make strategy for revenue share or content acquisition from 3rd party developer to create mobile money application. In Advanced way mobile operator can bring open API for developers. This way can speed up content creation for market. At least operator will choose suitable mobile money content and application for customers. Revenue share or acquisition with individual/small content developer or even big content developer by give them software development kit. By this way operator can get revenue through share of service revenue.

The Barriers

While the Indonesian mobile money sector has many strong attributes, including multiple competitors, technology, strong mobile penetration, coverage, and a significant underserved market segment, current mobile money adoption and usage levels are below expectations. Two primary reasons for this are regulatory policies and mobile money provider commitment. On the regulatory front, Bank Indonesia has been actively reviewing its mobile money policies. Current rules require mobile money agents to be formally registered businesses, and most apply individually for the appropriate agent licenses. These restrictions greatly hamper a mobile money provider’s ability to sign up agents, particularly small retail businesses. Consequently, the availability of mobile money agents in Indonesia is extremely low, greatly limiting the utility of the service. In addition to regulatory impediments, the mobile money sector can also be characterized by a lack of urgency on the part of service providers. Mobile operators did not view expanding mobile money services as a top priority, and available resources have been limited. To date, the business case for mobile operators to invest heavily in agent networks, customer acquisition, merchant promotions and incentives has not been made. For most mobile operators, mobile money is a competitive necessity that supports broader churn reduction efforts rather than a core source of profits. Banks and other financial institutions also have not actively promoted their mobile money capabilities and have not effectively used the mobile channel’s cost advantage as a mechanism to move down-market and acquire previously unbanked customers. Currently they are concentrating for internet banking, EDC machine and ATM as main cost transaction reduction strategy, not yet from mobile banking. Only few mobile banking transaction has been carried from banks. But, most banks have viewed mobile money as a cost reduction tool to lower transaction costs for existing customers. Several banks are reevaluating this position, with a few engaging in mobile money pilots that will test the efficacy of using mobile money to acquire and service low-end customers.

As conclusion, Mobile money offers numerous benefits in emerging markets. They ensure the safety and security of money, make payments more convenient and promote M-Commerce opportunities for local entrepreneurs. They also present opportunities for foreign companies looking to move into these markets, as well as learning’s for those who want to implement similar mobile finance models in developed markets

Author : Iqbal Zulkarnain